Betting on Racing’s Future

Are European governments fully recognising the economic value of racing and how can the betting landscape evolve beyond 2026?

Words - Mark RowntreeWith a close-linked relationship to gambling, horse racing has been drawn into increasingly vociferous political discussions. Across Europe and beyond, the impact of ever stricter regulation, coupled with increased taxation, provides a more challenging landscape to navigate.

Sweden has some of the most draconian gambling policies in Europe, with the last land-based casino there set to close in January 2026. Meanwhile, i the United Kingdom, the Gambling Commission is clear that it views gambling “as a leisure activity that needs strict regulation to protect vulnerable people / children from harm.”

Funding for horse racing in the UK stems from levy and media rights payments, so most within the British horseracing industry breathed a huge sigh of relief in November 2025, when the Chancellor Rachel Reeves announced in her Budget that the rate of duty for betting on horse racing would remain unchanged at 15%. The British Horseracing Authority (BHA) eager to hail their “Axe The Racing Tax” campaign as a rip-roaring success.

However, the other side is that the current Labour Government chose to focus their attention on the gambling industry instead to generate increased revenue from taxation, nominating social responsibilities as a key driver. The Remote Gaming Duty (RGD) – the tax on profits from online slots and casino games – rose from 21% to 40%, and the tax for online betting on other sports rose from 15% to 25%. With British horse racing so heavily dependent on bookmakers for sponsorship and wider exposure, and bookmakers struggling to ‘balance the books,’ the negative kickback from these decisions is immediately obvious.

Nevertheless, to overcome any threat, one must be prepared to ‘think outside of the box’ and be willing to adapt to the new less familiar, or more challenging, environment. Horse Racing and the wider gambling industry must adopt similar attitudes to make progress through turbulent times. So how does the sport and the gambling industry make these positive moves?

Now is the time for innovative thinkers to step forward.

In many jurisdictions, betting via Tote pools is commonplace, with the World Tote Association (WoTA) stating in Martin Purbrick’s ‘Tote Betting And Horse Racing: Tax, Responsible Gambling, And The Contribution to Society’ report, that evidence from 77 jurisdictions highlights how pool betting can best help to ensure a successful future for horseracing around the globe.

The World Tote Association – counting 24 tote operators representing a turnover of more than €30 billion, and 10 Associate members – is in their own words “responsible for bringing together Tote/parimutuel betting operators from around the world to promote and support the horseracing industry in a socially responsible and sustainable manner”.

The key findings of that WoTA report identifying that Tote betting can make a significant contribution to society, is inherently different from fixed odds betting, and is fundamental to the economic structure of horse racing. However, Tote betting does suffer from some structural tax problems, and increasing the taxation rate on betting, does not inversely reduce problem gambling.

The Hong Kong Jockey Club (HKJC) Chief Executive Winfried Engelbrecht-Bresges was quoted in the Racing Post (on 17th September 2025) referencing similar obstacles when discussing the growth of pool betting, principally the World Pool, “We [the HKJC] had to demonstrate in Hong Kong that the expansion in the number of gaming opportunities would not lead to gambling harm.”

World Pool, self-labelled as “an innovative version of international commingling”, aims to bring the world’s finest racing to a global audience, hosting races, or fixtures worldwide, including in Hong Kong, Dubai, Saudi Arabia, South Africa, New Zealand, the United Kingdom, Ireland, and Germany.

Tim Carroll, an experienced punter who works in the media as a broadcaster and writer, is a staunch advocate for Hong Kong pool betting,

“The set up in Hong Kong is great for the owner, trainer, jockey, and punter. Everything you need is there, horse weights, every single piece of work is documented, vet records, barrier trial replays etc, and it’s all free. It is so positive for the punter, and, from that perspective, Hong Kong is the best place to bet in the world.”

“The Hong Kong Jockey Club pools (including World Pool) are strong in terms of liquidity and cater for recreational punters, more serious individual players, and the larger high-staking syndicates.”

Carroll, who also speaks positively about fixed odds betting from more traditional bookmakers in the UK, reflected on his recent visit to Australia for the Melbourne Cup when discussing the popularity of the Totalisator Agency Board (TAB). Across Australian states many pubs, bars, and hotels offer on-premises betting facilities, usually through dedicated areas known as TABs, which operate in a comparable way to the Pari-Mutuel in France.

“There is a lot of racing there and if someone wants to put a large bet on a horse, the bet will be taken on the Tote. That has been the case for years. However, you do need liquidity in those pools and Australia doesn’t have the same degree of liquidity as in Hong Kong or with the World Pool. It does exist for feature races such as the Melbourne Cup, the Caulfield Cup, and the Golden Slipper, with many of those now also covered by the World Pool, but for many of the other day-to-day fixtures, a large five-figure bet can distort the true price of a horse.”

“The best example of this I can think of is when the Japanese champion, Deep Impact, contested the 2006 Prix de l’Arc de Triomphe there was a weight of loyal money from Japanese punters who poured millions into the parimutuel pool which saw the horse go off at 1.5 on the French tote when he was priced up at 9-4 with the [UK] firms.”

Sports-style bars are far less common in the UK and Ireland, although Paddy’s Sportsbook has recently opened a sizeable facility in the Hippodrome Casino in Central London, the first of its kind in Europe.

Sports-style bars are far less common in the UK and Ireland, although Paddy’s Sportsbook has recently introduced a sizeable facility in the Hippodrome Casino in Central London. Carroll is a massive fan of the facilities in his native Australia, highlighting their direct benefits to horse racing,

“I like the fact that in Australia you see horse racing in just about every pub or club. It doesn’t matter where you go, people are watching racing, so they become accustomed to it.”

“Because it is in an environment where you have Mums and Dads (and even kids), it has more of a sports club atmosphere, alongside the pooltables and dart boards. It has a nice appeal about it socially with horse racing or greyhound racing enjoyed by a sizable proportion of people.”

“For example, I’ll be there with my wife, she might have a couple of bets, whereas I’ll be taking more of an interest, but later in the afternoon we’ll go and sit down and have dinner in the pub. It’s a nice environment which sells the industry. I’ve been living in the UK for so long you tend to forget but, being back there recently, I feel that the buy-in from the public for horse racing and gambling is far better over in Australia.”

To some extent, the United Kingdom has been left trailing in the wake of other countries like Hong Kong, France, and Australia. The mainstream bookmakers – all left feeling incredibly deflated from tax increases on their businesses, premises overheads skyrocketing, and fees rising for various media rights packages.

Meanwhile, it is also a known fact that the pub trade is struggling across the UK, with figures for the British Beer and Pub Association (BBPA) expecting to see a pub closing every single day in 2025.

Acknowledging that there are likely to be significant political hurdles and perhaps even religious considerations to overcome, you can’t help but ponder the prospective added-value from the establishment of horse racing-related betting – either through pools or bookmakers – within those UK pubs and clubs which are continuing to perform above expectations.

For example, the J.D. Wetherspoon chain has over 800 locations across the UK, in addition to having over fifty hotels. Their founder Tim Martin is so often an outspoken Government critic, and unafraid to challenge/question the status quo. There are other similar pub groups – i.e. Greene King – who could also feasibly be willing to enter negotiations.

Such expansion, or even a simple modernisation exercise, could represent a win, win scenario for major bookmakers, or indeed for Britbet, the UK pool host and operator for 19 British racecourses.

Rob Waterhouse, a bookmaker, and the husband of legendary Australian trainer Gai Waterhouse also speaks with conviction about the issues facing the horse racing industry worldwide, condemning the constant barrage of negativity towards gambling,

“It’s a constant problem in this woke world, isn’t it? I suppose what I would say is that I think that it is a marvelous thing that the working man can have a bet and do the form, putting some intellectual exercise into finding a winner, which is perhaps his only opportunity in life to do so. It is very much part of the sport.”

“The problem is that in this world we live in, more and more money is being spent on social welfare and, as such, that money must come from somewhere, so gambling, of all sins, is an easy target. It’s a great shame.”

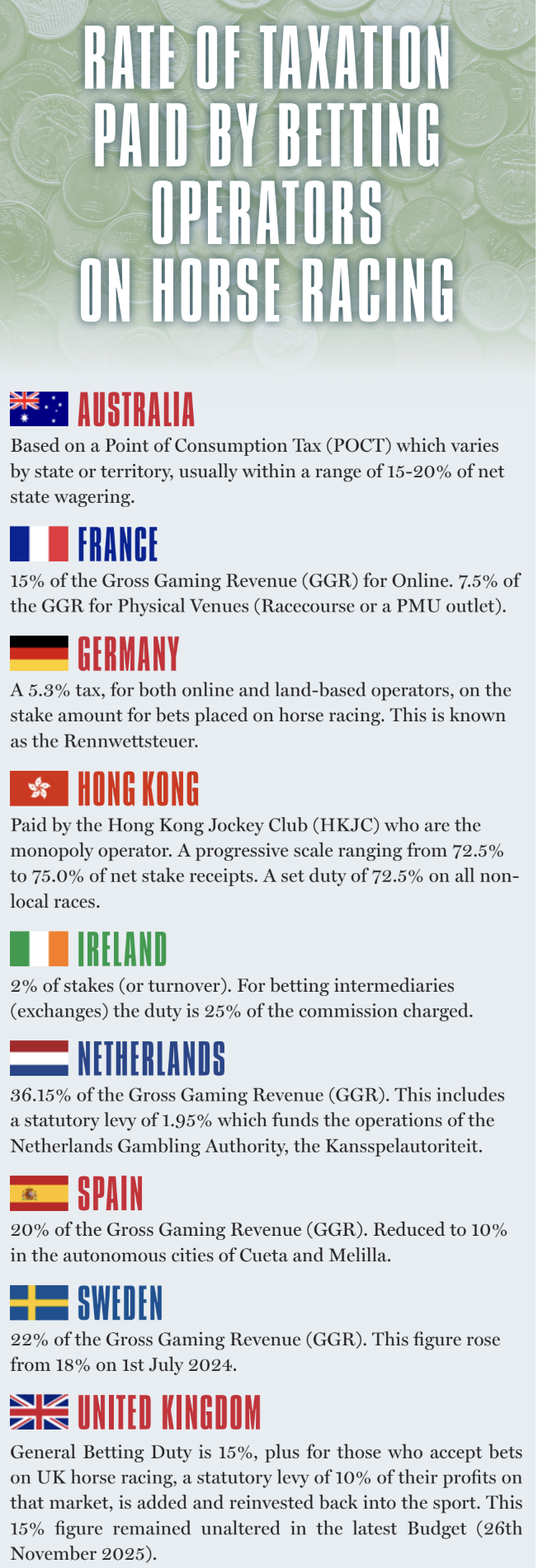

Although undeniable that strict regulations and major tax hikes – those taxes as high as 36.15% of Gross Gaming Revenue (GGR) in the Netherlands – are serving to punish the bookmaking industry, Waterhouse recognises that the ‘cost of living crisis’ has also had a direct impact on the habits of punters.

“In addition to betting on-course at Royal Ascot, I also bet in Sydney, in Melbourne, and in other places around Australia, and there is no doubt that cash has disappeared from people’s pockets.”

In stark contrast to this overall gloomy economic outlook, racecourse attendances are holding up well across Australia, with similar trends developing in the UK.

Nevertheless, this doesn’t always correlate with increased turnover for the traditional on-course bookmakers, with the ‘type of customers’ attending, and the recent emergence of ‘in-house’ bookmakers’ directly impacting on the volume of business.

Waterhouse has witnessed this shift of clientele stating, “as a bookmaker, I’d rather have ‘racing people’ at a meeting rather than people who are going to party and drink champagne” but he goes way further in condemning the ‘lack of value’ offered by ‘in-house’ bookmakers.

“The UK isn’t my country, but I do think that it is wrong that racecourses are bringing in their own ‘in-house’ bookmakers, or Tote systems. These operators are charging huge overrounds, which is so mean on the punters. I think the punters get a bad deal from [some] racecourses. It is wrong that they should do it. To me, it is almost stealing from the punters, so it is very bad.”

Despite these challenges, the primary focus for Waterhouse remains his profitable betting shops and on-course business, the online market now seen as being of little added value.

“Our turnovers have dropped but thankfully, the taxes are quite low for on-course bookmakers in Australia, as is the case in the UK. I have been involved with three online businesses, and I’ve sold all three. They [the Government] just keep on increasing the taxes on online businesses to the point where it’s just not profitable, so that brings great sadness.”

On-course bookmakers have next to nothing to fear from either black-market operators, or the ever more stringent affordability checks placed on customers by licensed and regulated online operators. Waterhouse is eager to promote the benefits of betting on track.

“In Australia there has been a rise [in black-market operators], with several people advertising themselves as bookmakers but they don’t have a license and have invariably taken the lot and not paid winning punters. I don’t speak with authority, but I suspect there will be a lot of people ringing their on-course bookmakers to bet because their taxes are lower.”

“As I understand it, in England, if you go into a betting shop there and want £100 on a horse, they’ll ask you to prove that you can afford it, requesting your bank records and proof of income and whatever else. It all seems very strange.”

So, with every single dimension of the bookmaking industry across Europe, Australia, and beyond, under threat, and the average yearling price in Australia for 2025 around A$149,000, ownership viewed by Rob Waterhouse as being “too expensive for the average person”, where do we go for a solution?

As Waterhouse correctly identifies, “Horse Racing is one of those great things where everyone can start a conversation about horses, or what have you backed here, or are you winning? It’s easy to start a conversation in relation to horse racing.”

For me, as the author of this report and as an enthusiastic devotee to horse racing, it is these channels of dialogue that remain key. It is essential that those who elect to devote their working lives to bookmaking, or the wider horse racing industry, remain united to the cause for the sport to thrive. It is simple; now isn’t the time for division, or worse, for self-preservation.

The key decision makers require foresight and a brave, bold new vision. There are a multitude of opportunities for horse racing and bookmaking to flourish as a collective force. Industry leaders in Britain, Ireland, France, Germany, Spain, Sweden, Australia, and wherever else, need to brace for a fierce political battle and, like their counterparts in Hong Kong, shift the narrative from a ‘risk of harm and addiction’ to focus on showcasing opportunities for growth and investment. With risk comes opportunity, and so often fortune favours the brave.

How Does the Regulatory Environment for Pool Betting Impact on the Financial Health of Horseracing Around the World?

Simon Bazalgette, the founding Chair of specialist management consultancy GVS EQ, and Martin Purbrick, a founding GVS EQ associate, take a canter around the world to see how betting regulation, and particularly pool betting, has a vital impact on the relative level of prize money, and therefore the financial health of the sport.

For the last century and beyond, Horseracing has had a symbiotic relationship with betting, and this remains the case in most countries – to a greater or lesser extent. As a result, the financial strength of each national horseracing industry depends on the way that betting is regulated and owned in that country. An understanding of a national regulatory structure for betting is vital for any understanding the wide variation of prize money in different countries.

Pool betting, also known as ‘Tote betting’ or ‘pari-mutuel betting’, has long been associated with horse racing. Tote betting was established in the 19th century and involves all the amounts bet combined in a pool, from which the operator takes a cut, then the odds are calculated based on the proportions wagered on each outcome. Totalisator odds are different to fixed odds in that they are not set until the race begins, no more bets are accepted and the total amount in the pool is finalised.

Tote operators were created to harness wagering to support the sustainability of racing, the welfare of horses, as well as employment for the large numbers of people involved in the sport around the world. Horse racing is a high cost and capital intensive sport to organise and operate, and requires considerable sustainable funding to survive.

In markets with strong totes such as Japan, Hong Kong and France, racing generally does relatively well. In countries where other forms of betting have been licensed, racing can still do well if there is a fair balance of funding provided back to the sport from all types of betting. Australia would be a good example of this. In the US the position is rapidly changing from a pure racing tote market with the introduction of sports betting.

In the UK, the introduction of off course fixed odds betting in the early 1960s, with a relatively loose link to horseracing, has meant that British horseracing has lost pace with its fellow racing jurisdictions around the world when it comes to prize money and investment in the sport from the betting industry.

In South Africa and Australia there remains a mixed economy of fixed odds and pool betting. Australian racing has strong statutory support to ensure a meaningful percentage of betting revenues goes to horseracing ensures that prize money levels remain internationally competitive.

For many years there has been a steady but less than speedy process of the official totes connecting with each other to combine pools on racing – commonly known as commingling. There are several reasons for the slow progress, primarily the different bet types and conditions attached to similar bet types, but also the commingling technology (ITSP) which has been in place for more than 20 years but is still embedded in many heritage platforms. The most important development in commingling has been the World Pool, which is hosted by the Hong Kong Jockey Club.

In addition to the main national or state totes, there are a number of private pool operators who offer access to the pools particularly for large international players who offer significant liquidity to the market.

Some countries, particularly the Gulf States, do not have licensed betting of any sort, and the sport relies mainly on the financial support of the state, the royal families and rich owners.

To a large degree, the level of funding available for horseracing is dependent on the level of support that national or state regulations provide, particularly with regard to funding from betting, and therefore any attempt to assume that success in one country can be used as a template for another should be treated with great caution.

Let’s take a high level look at what this means for the major racing jurisdictions.

France

The French pool betting market is around €9 billion annually, the profits from which are reinvested back into the sport. It is notable for its wide retail distribution through the vast network of over 20,000 tabacs (tobacco and convenience stores) in the country.

Pool betting in France is primarily controlled and run by the PMU despite attempts to open up the market over the last decade or so. The PMU returns all its benefits to the 66 French horse racing companies organising gallop and trotting races (France Galop and Le Trot), sustaining more than 60,000 direct and indirect jobs throughout France.

In 2023, the PMU paid a total contribution of 835 million euros to France Galop and Le Trot. This financial contribution supported the operation of 233 racetracks and 26,000 horses in training.

Other types of betting operator have been licensed in France since 2010 but they remain heavily restricted and take only a very small share of the French horserace betting market.

Japan

The Japan Racing Association (JRA) is the custodian of horse racing and also tote betting at the national level. Pool betting on racing in Japan generated a betting turnover of over 2.5 trillion Yen (Euro 15 billion). The JRA is required to provide 10% of its gross betting turnover to the national treasury, as well as 50% of any surplus profits remaining at the end of the fiscal year. Three-quarters of the contribution must be used for improvement of livestock breeding and the JRA also contributes additional funds to horse breeding as well as the promotion of equestrian culture.

It is no coincidence that Japanese racing offers the largest pool of prize money in the world, given the JRA’s control of horserace betting in Japan under its vertically integrated sole licensed operator. Betting on other sports is also limited to only a small number of local sports such as bicycle, boat and motor racing.

The Japanese pool is restricted from commingling with other international pool operators, with only limited pilot trials having taken place to date. Typically this is driven by the presence of Japanese runners in overseas races, to allow Japanese punters to bet on these horses. When this does take place, it generally has a major impact because the level of Japanese betting will be significantly larger than the home pool.

Hong Kong

Hong Kong has vertically integrated racing and pool betting, operated by the Hong Kong Jockey Club (HKJC). It generates around HK$130 billion (€15 billion) in annual betting turnover, with the HKJC being the largest corporate taxpayer in Hong Kong, and operating one of the world’s largest and most active charitable trusts. All surplus funds after operating expenses are either reinvested in racing or passed to the HKJC Charities Trust.

Most recently, the HKJC has become the host of the most successful international pool betting initiative, the World Pool and involves a collaboration of over 25 racing jurisdictions allowing customers to bet into a single pool involving enormous liquidity. This enlarged liquidity ensures that there are less odds (price) variations in smaller betting markets and better value for all betting customers. In the 2023/24 racing season, there are 45 World Pool fixtures at racecourses around the world, and the number is likely to continue to grow.

By allowing international horseracing fans the ability to bet into one pool on the major group races around the world, it has created a significant additional betting revenue stream in other territories whereby, for example, racedays such as the Epsom Derby, Caulfield Cup and the Dubai World Cup benefit from the significant level of betting that can be generated.

United States

In the US, betting is regulated at the state level and historically was limited to pari mutuel betting on horseracing.

Alongside this there were some examples of licensed casinos or slots which would usually be allowed only on racecourses or designated casino sites. Where a racecourse had such additional betting, it would significantly increase the level of prize money that racecourse could offer compared to other US racecourses.

The first Off Track Betting (OTB) service for horseracing was licensed in New York State in the 1970s, and rolled out in a number of states thereafter. These have been superseded by account deposit wagering services (ADWs). Horseracing remained the prime beneficiary of the OTBs and ADWs until in 2018 a Supreme Court ruling opened up the potential for states to licence fixed odds sports betting and almost 40 states have now done so to some extent.

US horserace pool betting is dominated by the two major racetrack groups - Churchill Downs (through its Twin Spires service) and the Stronach group (through their 1/ST and Xpressbet services). The two groups also own two of the major tote tech companies, United Tote (CD) and Amtote (1/ST). Churchill recently announced that NYRA (the racing operator in NY State) had completed its purchase of a 49% stake in United Tote.

Licensed betting on horseracing remains around $10 billion pa but betting on other sports has grown to over $90 billion pa.

United Kingdom

The UK has arguably the most competitive licensing environment for betting in the world. The UK Tote was created by Winston Churchill (a Jockey Club member) in 1926 as an independent body run for the good of racing; but unlike other countries, its betting monopoly was ended in the early 1960s with the creation of licensed fixed odds betting shops. Also unlike elsewhere, British horseracing was given no control over the off-course market, but instead a statutory levy was created to ensure that a small proportion of the profits from betting on horseracing was passed through to contribute to the financing of the sport.

Since that time, pool betting has had a declining share of the betting market and currently represents around 10%. The UK is dominated by fixed odds operators, and while British punters have the widest choice of competitive bets in the world, they also benefit from the highest return on bets in the world. This means that pool betting, with its higher take-out rates, struggles to match the pricing for fixed odds for simple bets, but is more competitive in so-called exotic bets, particularly the Place Pot.

The Levy is currently set at 10% of gross margin on betting on domestic horseracing, which, due to the highly competitive market and the low margins, is the equivalent of around 0.7% of betting turnover, amongst the lowest return from betting to horseracing in the world.

There have been various attempts to bring the Tote closer to racing, either through transferring its ownership to the sport, or through a preferential sale to racing, but these attempts have all failed. In 2011, the Tote was nationalised and then sold to the bookmaker group, Betfred, who sold it on to its current owners (which includes several large owners and breeders) in 2018. The UK Tote has had a commercial arrangement with the British racecourses (via their shared on-course betting company, Britbet) which is due for renewal in 2025.

Horserace betting remains at a significant level in the UK, c£5bn pa, second in Europe to France, but due to the difference to the regulatory structures, the amount transferred to the sport is significantly lower than in France.

Australia

Australia is arguably the best example of a mixed economy of pool and fixed odds betting, all of which provides significant funding back into horseracing.

Each state and territory has its own regulatory authority for betting and racing. Betting is owned and run separately from the sport, and generates around €15 billion pa, which is pretty evenly split between pool betting and fixed odds.

Tabcorp Holdings, a public company, is the largest operator of pari-mutuel betting, running TAB-branded services across multiple states, and each state tends to have its own pool operator as well.

As in the UK betting operators are required to pay a proportion of their revenues to the sport, under what is known as Racing Fields regulations. The level required in Australia is significantly higher than the UK levy – typically between 1.5% and 3% of betting turnover - and allows Australian racing to offer prize money at the top end of international levels.

Ireland

The betting market in Ireland has many similarities to the UK. Betting on horseracing is around €1.1bn to €1.3bn each year, with Tote Ireland representing a small proportion (6%-7%). Betting operators pay a government levy which is paid over to the horseracing industry via Horse Racing Ireland (HRI), usually between €80m - €100m pa. This funding supports the development and promotion of the industry, racecourse maintenance and annual prize money of around €65m pa.

South Africa

South Africa is a market with a mixed economy between the original pool operator (the SA Tote, owned by Phumelela, the largest racecourse group) and fixed odds operators. Phumelela has arrangements in place with the National Horseracing Authority of South Africa to support prize money and the promotion of SA racing in the country.

Pool betting on horseracing is around €400m pa and represents around two thirds of the market, with fixed odds operators growing fast.

Conclusion

The financial contributions to racing from totes are a critical part of the sustainability of racing, supporting a huge number of jobs in the sport. However, the regulatory and tax structure for pool betting varies considerably around the world.

Most countries will have started from a similar position of the tote being the only form of licensed betting as explained by Sir Winston Churchill: “I have always believed that it was a good thing for the State to organise the totalisator and take control of this form of betting in order to eliminate illegal practices and to ensure that a proper proportion of the proceeds went to public purposes.”

The position in each country has diverged significantly over the last 100 years, and this means the impact on the funding for the sport is very different in each country. While there are areas of similarity, building greater collaboration between tote operators is a long road but one that can only benefit racing in the long term.