HENRY DE BROMHEAD - "I'M GOING TO TRY TO TRAIN A CLASSIC WINNER ONE DAY."

WORDS: DARAGH Ó CONCHÚIRHenry de Bromhead has had a good day. Another one.

A winner at Thurles is today's bounty. You surmise it could have been better, with two runner-up finishes from his other pair of representatives.

In trademark de Bromhead style, such notions of grandeur are rebuffed. Any visit to the track that includes a smiling debrief and a photo under the No 1 lollipop, is a good one. Especially when Messrs Mullins, Elliott and Cromwell are providing the opposition.

Still, it is reflective of the rich vein of form in which the Waterford trainer's string has been through the autumn and into the beginning of the winter campaign, as well as the seamless transition of Darragh O'Keeffe into the role as Knockeen's No 1 following the retirement in May of the incomparable Rachael Blackmore, that one in three is the least we are expecting.

October 2025 provided de Bromhead with his highest ever monthly tally of winners in Ireland (18) and a notably impressive strike rate (32%). His PB before that in terms of victories was 17 in September 2020 at a clip of 30%, and in terms of strike rate was 31% in November 2024, when he still managed to record 16 winners. There are clearly some strong summer months too, such as the 11 well-earned triumphs recorded in July 2024.

This is not a coincidence. It is, to a considerable degree, as a result of a policy of not going the full 12 rounds with his sport's heavyweights.

The subsequent bounty from such guerilla tactics is not just about short-term gain, however. The strategy's prime benefit is having the horses re-appear fresh and in mint condition after a mid-term break, for when the gloves must come off in the spring, particularly at Cheltenham.

So our expectations are an indication too of de Bromhead's position as one of the greatest to ever condition a national hunt horse, transforming a boutique establishment set up by his father Harry, from whence Fissure Seal won what is now the Pertemps final for a syndicate of dentists in 1993.

He is the only trainer to be victorious in the Gold Cup, Champion Hurdle and Champion Chase in the one week, as achieved when Minella Indo, Honeysuckle and Put The Kettle On prevailed among six festival winners in 2021.

He added the Grand National as Minella Times launched Blackmore into the stratosphere a few weeks later, repeating his Gold Cup feat of saddling the runner-up also. Stupendously, there was another 1-2 when the Gold Cup placings were reversed by A Plus Tard in 2022.

Yet despite having all of Cheltenham's championship races (2 Gold Cups, 2 Champion Hurdles, 4 Champion Chases and a Stayers' Hurdle), the National, a total of 61 Grade 1s and 25 Cheltenham Festival winners on his vaunted CV, he chose to expand into the flat sphere to improve the profitability of his business.

Being Henry de Bromhead, he has proven very astute and adept in this department. In June 2025, he registered his first Royal Ascot success thanks to Ascending and would go on to record his best tally of winners in Ireland, on the level, in the calendar year with 17.

There are six group races on the resumé now, Blackmore highlighting her versatility when steering future Group 2 winner Terms Of Endearment to victory in the Bronte Cup at York in May 2024. But peruse the variety of venues at which those prizes were plundered: Toulouse, Goodwood, York, Sandown and Cork. So imaginative. So smart.

Some might find it incongruous that a man at the very top of his profession has serious concerns about the future of his sport, and industry. But, of course, his voice carries more weight for that.

De Bromhead gets uncharacteristically animated when discussing the funding of horse racing, and speaks about it, mostly uninterrupted, for nearly ten minutes. He is appalled by a model he believes is inimical to the interests of the sport and all who gain a living from it. In particular, he is passionate about the need to cut the umbilical cord between racing and the giant bookmaking corporations and is lobbying to build momentum towards racing creating its own betting company, with a view to becoming self-sustainable. This is something he believes is achievable within 10-15 years of such a venture being set up. More of which, anon.

We have become accustomed to the de Bromhead periodical fecundity, when the ground has yet to get bottomless, his "nicer sort of winter horses" are unleashed and Closutton and Cullentra, in particular, have yet to activate their 'Drag Reduction System. Often, there has been a lull in January and February, and there have been a few years where pundits and punters alike have wondered about the form of the de Bromhead representatives going into March. We know better now.

"It sort of worked for us over the years. We generally aim to have those festival horses ready from October onwards, depending on ground. Horses that prefer nicer ground would be earlier, horses that prefer softer ground would be a little bit later, but we generally aim to have them out by the end of October, November time. And we'd probably go to Christmas with them.

"So I'm never sure then... you could call it a lull. But also, we'd put away a lot of our horses in January with a view to the spring. So it's just worked for us over the years. I suppose you're trying to start a little bit earlier than Willie, for example, because you know, otherwise, you're coming up against all his big guns from now on.

"It's a case of sticking with what has worked before. I suppose we're creatures of habit, a lot of trainers, and that has worked well for us over the years. We'd always be aiming towards Christmas, trying to have two or three runs under their belts and then try and freshen them up before the spring."

It is quite something to be setting new landmarks not long after all the great champions have retired. The Minellas Indo and Times, A Plus Tard, Champion Chase heroine Put The Kettle on and the equine queen of Knockeen, dual Champion Hurdler and four-time Cheltenham victress, Honeysuckle.

But cycles conclude and you plan for the next great challenge, even after you have scaled Everest. Not that you are ever buying a horse with anything more than hope.

"I'm not sure you can plan for a Honeysuckle or Indo, that they were going to go on and do what they were going to do. Put The Kettle On, we bought as a store. We were very lucky that these horses came along. These were horses you dream of having, that you might get one in a lifetime, and they suddenly came within a couple of years of each other.

"We don't restock with as many horses as some of the bigger yards every year. I think it's sort of comparable to football teams with transfer markets. The bigger you are, the more you have to spend, the more new horses coming into your system, and then the more likely you are to come upon these top horses. That's what we're all striving to get.

"With what we have to spend, we wouldn't have as many young horses coming through as some of the big yards. So maybe it's less frequent we're going to come upon them, but we know we have the system. When we get them, we will produce. We'll get the best out of them and hopefully give them every chance to get to those blue riband events.

"Ultimately, when any of us are buying them, none of us actually know. You have your systems that work for you, but no one knows which one is going to be the champion until you get them into your system. We had that period with all those amazing horses that we had, and we've still got some really nice horses and some really nice young ones coming through this year. We hope that we will bring them through to compete in those big races."

He covers the gamut of markets in terms of acquiring French stock, point-to-pointers and stores. Like everyone, he is trying to find value.

"Some of our clients buy their own horses and send them in. Some of them ask us to find horses for them. So we have spotters at the point-to-points that help us source these horses. Gerry Hogan helps us. Alex Elliott has helped us, with plenty of agents that put horses to us or our clients.

"That's the way we buy stores as well, though it's less stores. We have had more luck with form horses, but, we still had a Gold Cup horse as a store, Sizing John. We didn't train him when he won it, but we sourced him as a store and we sourced Sizing Europe as a store, the likes of Special Tiara, Put The Kettle On.

"D'you know what? The more I think of it, they nearly find you, those real ones. But once you have a system that you can produce and nurture them to be that class... once you have that, you've got to stick to that and hope that your policies work."

Sticking to what work does not mean you are not constantly evaluating and re-evaluating.

"If I was to criticise myself, maybe I'm not aggressive enough or proactive enough with my buying policy. I think we've got a good way of sourcing, and it's worked for us very well over the years but maybe I could be more proactive. We've got brilliant clients who support us. We get really nice horses to train and try to get from 150 (rated) to 170, those horses are so hard to find, and they're the ones we all want."

De Bromhead likes the way Knockeen works now, the rhythms. Expanding would change that. It goes back to the reasonable policy of not taking a scalpel to a healthy patient. If it ain't broke, and all that. He is very comfortable with the scale of the operation.

"It means we can be a bit more bespoke to horses and try and suit them, rather than them suiting a system for us. The thing for us is trying to nurture them along. Since I started training, probably one of the main things for me was... it's so hard to get a good horse, when you get a good one, it's trying to get that longevity. And I think we've proven that over the years with the likes of Honeysuckle, Envoi Allen, Bob Olinger, Minella Indo, Sizing Europe. Once you get those good horses, you're trying to maintain them and keep them going at the highest level for as long as you can." It speaks volumes.

There has been one monumental alteration to the landscape though, in the ascension of O'Keeffe to the throne vacated by Blackmore. De Bromhead was well established prior to her arrival at Knockeen - Sizing Europe, Special Tiara, Sizing John, Petit Mouchoir, Identity Thief, Champagne West, Shanahan's Turn and Days Hotel all pre-dated the Killenaule marvel.

But it is inarguable that he rocketed to another level in conjunction with her. They became behemoths, growing together. Blackmore has been the pilot for 31 of his 61 Grade 1s. Andrew Lynch is the next highest provider with seven. She was in the plate for 16 of the 25 Cheltenham triumphs. They were inextricably linked as they soared to the moon.

O'Keeffe had been used regularly since delivering A Plus Tard from the clouds to win the Savills Chase at Christmas in 2020. It was the teenager's first ride in a Grade 1. He scored on Maskada in the Grand Annual a little more than two years later. Right now, the Doneraile native is miles clear of Jack Kennedy and Paul Townend in the race to add the champion jockey title to his conditional crown, though the latter pair are now in full cry with their primary employers, Elliott and Mullins.

"That's been really good," de Bromhead concurs. "What we achieved with Rachael was incredible, and she was amazing to work with. And we had some unbelievable years. That's a good point about how we grew with Rachael. Rachael really helped us grow as well. She was incredible, what she brought to the table.

"But Darragh rode A Plus Tard in the Savills Chase and everyone said, 'God, fair play, you're putting up a 19-year- old. I didn't even know he was 19. I had thought he was a lot older, it felt that he was around a lot longer. He's always been working away with us, so I'm delighted to see him taking his opportunities. It's very similar to Rachael. He's a brilliant rider. He's really so clued in. He wants it as much as we do.

"Obviously, there was a window last autumn where Rachael was unfortunate to get that injury (broken neck), and Darragh stepped in and did really well. So it was encouraging to see that, but I didn't know Rachael was going to retire when she did. I had no idea, to be honest, but at least we knew that Darragh had stepped into it for a while and did really well."

He has taken to utilising Billy Lee more in recent years too and it was the Limerick man that was on board when Ascending denied Nurburgring by a neck in the Ascot Stakes last June.

"That was an incredible day for a number of reasons. I always wanted to have a winner at Royal Ascot, so it was brilliant to tick that box. We'd love to train a few more. What made it extra special was getting it for the Joneses, with Chris and Afra there and the boys. That was brilliant. Chris and Afra have always been brilliant supporters of ours. We got a real kick out of that."

Seamie Heffernan was on board Ascending with what we now know was the impossible task of attempting to overcome Ethical Diamond in the Ebor, getting only six pounds from the subsequent Breeders' Cup Turf hero. De Bromhead saddled Magical Zoe to win the valuable prize 12 months previously.

"We went into (flat racing) from a trading perspective. My view is, as a jumps trainer, I don't like to train and trade. In my opinion, they don't really go well, it just doesn't suit me. I like to buy horses for jumps clients independent of us, being from point-to-points or whatever. So I never really wanted to trade jumpers.

"But we have this infrastructure, and we have a great team at home. So I think it was probably about seven or eight years ago that we said we'd just dabble in it and see, and bought a couple of fillies, and they sold really well, and it became a good trade. It started well, so we continued doing it. We got some great trades out of it and we can have a piece of the pie as well in that."

Commerce may have been the motive for dipping the toe into the summer game but the competitive juices are flowing now and a little taste of the big time in that sector has induced the germination of a much greater career goal.

"This year we've had a good enough season. Owner-breeders have sent us some nice horses, and some clients have bought a few nice horses for us as well. So, it's exciting.

"I'm going to try to train a Classic winner one day. "You have to have ambition. It's something we enjoy doing. Some of our clients really enjoy it, some like a bit of both. It's people's hobby but we want to achieve what we can."

The irony, which he acknowledges, is that the international market that has helped him land some lovely touches, has had a direct impact on the NH world, with a significant reduction in flat horses making the transition to the jumps game due, in some part at least, to the phenomenal prize money available in the likes of Hong Kong, Australia, America and the Middle East.

"Oh absolutely. Now, obviously, you'd probably look more for a horse that likes a bit of soft ground off the flat, which mightn't suit these places but yeah, it has. It's definitely made them a lot more expensive. I've never bought many off the flat but it has made it harder."

It is financial reality that has led to this trend. The same financial reality that nudged de Bromhead towards his flat racing sideshow. And the same financial reality that winds him up to 90 when queried on the biggest challenge facing the industry right now.

"It's very simple. It's prize money. I've got a strong view on racing's association with corporate gambling companies. It's not bookmakers anymore. These are massive corporate gambling companies... the days of racing and bookmakers going hand-in- hand, that's completely different now. I think we're used as a shop window for the corporate gambling companies to get people to their sites, to bring them across to their online gaming, which is a far more profitable part of their business than gambling on racing. "I have a fairly radical view. I think we should be going pure Tote, like France, like all the richest racing nations, and I think it's achievable. We'd need more government support than we have at the moment, but I think we could become a self-funding industry within the next 10 to 15 years, like France, like Australia, who actually have allowed the corporates in, and they're already starting to see a fall in their TAB turnover, which is affecting finances.

"So I think it could get worse before it gets better. You listen to the likes of (HKJC CEO Winfried) Engelbrecht-Bresges, and British and Irish racing needs to move more towards pool betting. It's more punter-friendly. Even if you're a winner, you can get on. From what I hear, anyone who's a successful gambler, if you win with these corporates, you get shut down, you're not allowed to bet, which seems so fundamentally wrong to me.

"I think this new form of gambling (online casinos) is going like alcohol and cigarettes. It's getting to be a real taboo, and it's becoming socially and politically unacceptable. And racing is associated with that now."

Which makes it an easy target.

"And yet, you look at the addiction rates. I think you're three or four times more likely to be addicted to online casinos than you are betting on racing. And in racing, it's a skill. I can't see the difference between wagering on racing and wagering on stocks and shares. I actually can't. It's a skill. Some people are better at it than others and these corporate gambling companies won't allow the people that are good at it to wager. It all seems so fundamentally wrong to me.

"It would be a massive change, but I think if the Irish and British racing industry got together and got behind it (it would work). Racing is so popular, it's incredible. We sort of put ourselves down but I'm amazed, day-in, day-out, people that know about me, know what I do, that I didn't think would have had any interest in racing, and it's not from a betting perspective.

"I think we need to improve the engagement. You look at Japan. The whole story of where this horse that you are seeing racing today is told at the racecourses. We need to look at that." He is not talking about the midweek fixtures, when you might not find the worst sinner in attendance.

"You're gonna have to have industry days. They have those in France... but still, I think, the PMU gets something like 800 million, and the Exchequer gets 800 million. And there's something like 13 billion wagered on French racing worldwide, which is similar to Britain and Ireland, and yet they get 800 million to run French racing. Okay, I know it's decreased a tiny bit. But I think as an industry, we have to take ownership of that." He is rolling now.

"These ambassadors for these corporate gambling companies. I don't get that. I just don't get it. It was offered to me a few times, and I thought about it, but I didn't do it and I really wouldn't dream of doing it now. Now I think we should all become ambassadors for our industry, for our sport. And if that's the Tote or pool betting; it may not be the Tote. Something like the World Pool, but obviously for Ireland and Britain."

Self-sustainability should be the goal of administrators and participants alike, and de Bromhead is being proactive in attempting to build support for his idea.

"There's a few of us discussing it. That's the dream. It's going to take a lot of people to pull it together, and mainly the industry and all the stakeholders. That's the reality. This thing we're dependent on, corporate gambling companies, that bookmaker/ racing relationship is gone. They use us as a shop window to get people to convert them to their online casinos, and soon we're gonna not be really much use to them.

"In the previous media rights deal you were paid per race. Now it's a percentage of turnover. So if they don't price up a race, which they didn't at Bath last year, they don't have to pay us, whereas before, they had to pay seven or eight grand for that race. So I just think we need to get away from that."

It's what everyone wants but no one is sure how to achieve it. Yet. "We need more cohesion to achieve it and more industry buy- in to achieve it. But I think if you could point to people that you could be racing for a 30 grand maiden hurdle in time, I think that's massive for the industry and makes it more sound."

It is a credit to him that he is not just exercised by the malaise but offers a possible solution and is attempting to rally people to the cause. And all the while, keeping the home fires burning, as fruitfully as ever before.

Envoi Allen brought his tally of Grade 1s to ten - six under de Bromhead's tutelage - when winning Down Royal's Champion Chase for the third time last month. He clearly doesn't act at Kempton so after a break, will build towards spring and probably the Cheltenham Gold Cup.

Stayers' Hurdle champ, Bob Olinger is another who works back from Cheltenham, and Hiddenvalley Lake, in the same ownership, is a Grade 1 winner in that division too. Meanwhile Quilixios was alongside Marine Nationale when falling at the last in the Champion Chase, a race de Bromhead has won four times. The former Triumph Hurdle winner is back for more.

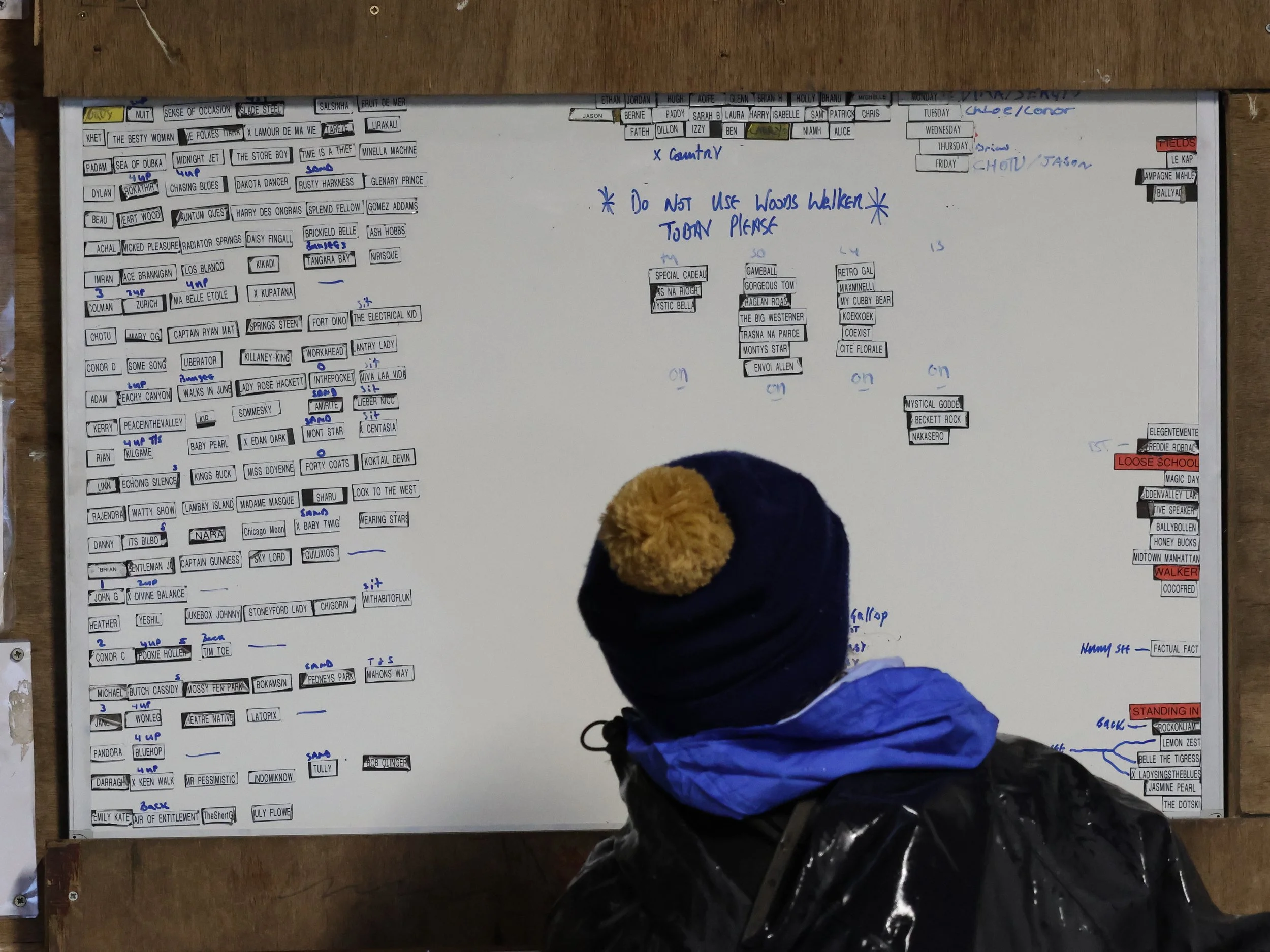

Then you have the raft of younger charges, such as July Flower, The Big Westerner, Forty Coats, Mister Pessimistic, Fruit De Mer, Slade Steel, Workahead, Gameball, Sky Lord, Tim Toe, Koktail Divin and Gomez Addams. And The Short Go and Monty's Star are more established chasers likely to pick up their share of prize money in the coming months. On paper, the succession planning has been shrewdly implemented.

"Obviously, the bubble bursts every now and again. But once you can keep the dream alive with a few nice horses, they'll all find their level and we'll keep trying to bring them through."

Betting on Racing’s Future

Are European governments fully recognising the economic value of racing and how can the betting landscape evolve beyond 2026?

Words - Mark RowntreeWith a close-linked relationship to gambling, horse racing has been drawn into increasingly vociferous political discussions. Across Europe and beyond, the impact of ever stricter regulation, coupled with increased taxation, provides a more challenging landscape to navigate.

Sweden has some of the most draconian gambling policies in Europe, with the last land-based casino there set to close in January 2026. Meanwhile, i the United Kingdom, the Gambling Commission is clear that it views gambling “as a leisure activity that needs strict regulation to protect vulnerable people / children from harm.”

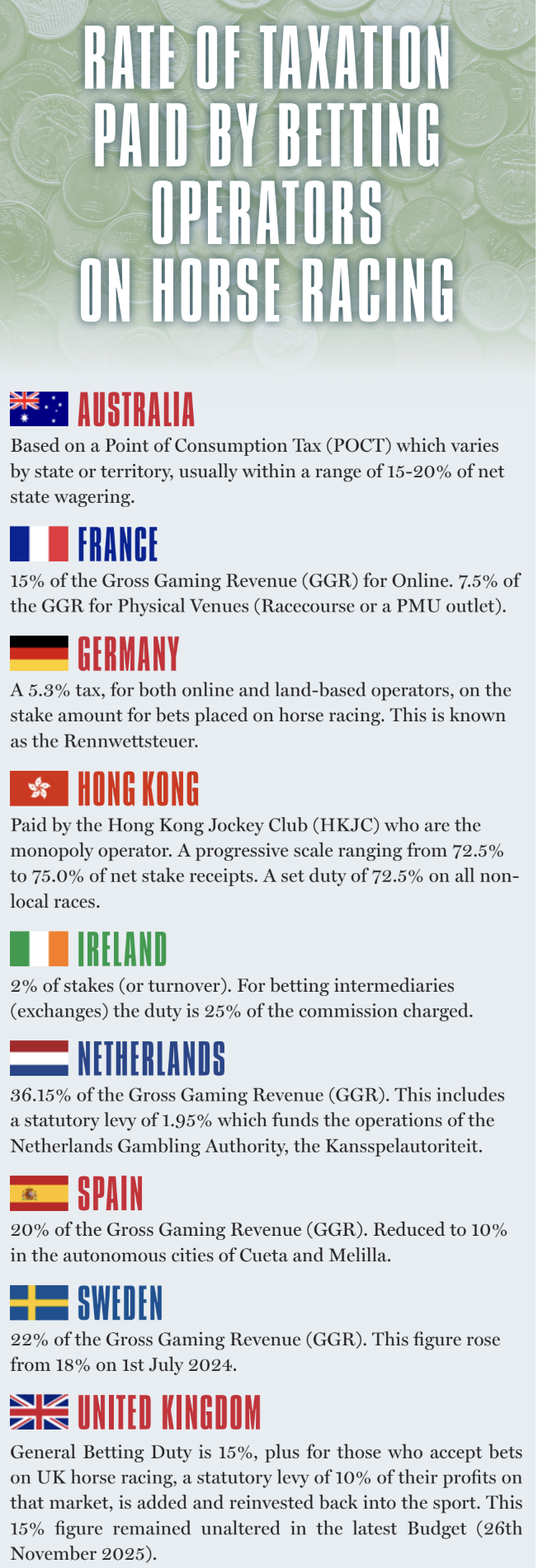

Funding for horse racing in the UK stems from levy and media rights payments, so most within the British horseracing industry breathed a huge sigh of relief in November 2025, when the Chancellor Rachel Reeves announced in her Budget that the rate of duty for betting on horse racing would remain unchanged at 15%. The British Horseracing Authority (BHA) eager to hail their “Axe The Racing Tax” campaign as a rip-roaring success.

However, the other side is that the current Labour Government chose to focus their attention on the gambling industry instead to generate increased revenue from taxation, nominating social responsibilities as a key driver. The Remote Gaming Duty (RGD) – the tax on profits from online slots and casino games – rose from 21% to 40%, and the tax for online betting on other sports rose from 15% to 25%. With British horse racing so heavily dependent on bookmakers for sponsorship and wider exposure, and bookmakers struggling to ‘balance the books,’ the negative kickback from these decisions is immediately obvious.

Nevertheless, to overcome any threat, one must be prepared to ‘think outside of the box’ and be willing to adapt to the new less familiar, or more challenging, environment. Horse Racing and the wider gambling industry must adopt similar attitudes to make progress through turbulent times. So how does the sport and the gambling industry make these positive moves?

Now is the time for innovative thinkers to step forward.

In many jurisdictions, betting via Tote pools is commonplace, with the World Tote Association (WoTA) stating in Martin Purbrick’s ‘Tote Betting And Horse Racing: Tax, Responsible Gambling, And The Contribution to Society’ report, that evidence from 77 jurisdictions highlights how pool betting can best help to ensure a successful future for horseracing around the globe.

The World Tote Association – counting 24 tote operators representing a turnover of more than €30 billion, and 10 Associate members – is in their own words “responsible for bringing together Tote/parimutuel betting operators from around the world to promote and support the horseracing industry in a socially responsible and sustainable manner”.

The key findings of that WoTA report identifying that Tote betting can make a significant contribution to society, is inherently different from fixed odds betting, and is fundamental to the economic structure of horse racing. However, Tote betting does suffer from some structural tax problems, and increasing the taxation rate on betting, does not inversely reduce problem gambling.

The Hong Kong Jockey Club (HKJC) Chief Executive Winfried Engelbrecht-Bresges was quoted in the Racing Post (on 17th September 2025) referencing similar obstacles when discussing the growth of pool betting, principally the World Pool, “We [the HKJC] had to demonstrate in Hong Kong that the expansion in the number of gaming opportunities would not lead to gambling harm.”

World Pool, self-labelled as “an innovative version of international commingling”, aims to bring the world’s finest racing to a global audience, hosting races, or fixtures worldwide, including in Hong Kong, Dubai, Saudi Arabia, South Africa, New Zealand, the United Kingdom, Ireland, and Germany.

Tim Carroll, an experienced punter who works in the media as a broadcaster and writer, is a staunch advocate for Hong Kong pool betting,

“The set up in Hong Kong is great for the owner, trainer, jockey, and punter. Everything you need is there, horse weights, every single piece of work is documented, vet records, barrier trial replays etc, and it’s all free. It is so positive for the punter, and, from that perspective, Hong Kong is the best place to bet in the world.”

“The Hong Kong Jockey Club pools (including World Pool) are strong in terms of liquidity and cater for recreational punters, more serious individual players, and the larger high-staking syndicates.”

Carroll, who also speaks positively about fixed odds betting from more traditional bookmakers in the UK, reflected on his recent visit to Australia for the Melbourne Cup when discussing the popularity of the Totalisator Agency Board (TAB). Across Australian states many pubs, bars, and hotels offer on-premises betting facilities, usually through dedicated areas known as TABs, which operate in a comparable way to the Pari-Mutuel in France.

“There is a lot of racing there and if someone wants to put a large bet on a horse, the bet will be taken on the Tote. That has been the case for years. However, you do need liquidity in those pools and Australia doesn’t have the same degree of liquidity as in Hong Kong or with the World Pool. It does exist for feature races such as the Melbourne Cup, the Caulfield Cup, and the Golden Slipper, with many of those now also covered by the World Pool, but for many of the other day-to-day fixtures, a large five-figure bet can distort the true price of a horse.”

“The best example of this I can think of is when the Japanese champion, Deep Impact, contested the 2006 Prix de l’Arc de Triomphe there was a weight of loyal money from Japanese punters who poured millions into the parimutuel pool which saw the horse go off at 1.5 on the French tote when he was priced up at 9-4 with the [UK] firms.”

Sports-style bars are far less common in the UK and Ireland, although Paddy’s Sportsbook has recently opened a sizeable facility in the Hippodrome Casino in Central London, the first of its kind in Europe.

Sports-style bars are far less common in the UK and Ireland, although Paddy’s Sportsbook has recently introduced a sizeable facility in the Hippodrome Casino in Central London. Carroll is a massive fan of the facilities in his native Australia, highlighting their direct benefits to horse racing,

“I like the fact that in Australia you see horse racing in just about every pub or club. It doesn’t matter where you go, people are watching racing, so they become accustomed to it.”

“Because it is in an environment where you have Mums and Dads (and even kids), it has more of a sports club atmosphere, alongside the pooltables and dart boards. It has a nice appeal about it socially with horse racing or greyhound racing enjoyed by a sizable proportion of people.”

“For example, I’ll be there with my wife, she might have a couple of bets, whereas I’ll be taking more of an interest, but later in the afternoon we’ll go and sit down and have dinner in the pub. It’s a nice environment which sells the industry. I’ve been living in the UK for so long you tend to forget but, being back there recently, I feel that the buy-in from the public for horse racing and gambling is far better over in Australia.”

To some extent, the United Kingdom has been left trailing in the wake of other countries like Hong Kong, France, and Australia. The mainstream bookmakers – all left feeling incredibly deflated from tax increases on their businesses, premises overheads skyrocketing, and fees rising for various media rights packages.

Meanwhile, it is also a known fact that the pub trade is struggling across the UK, with figures for the British Beer and Pub Association (BBPA) expecting to see a pub closing every single day in 2025.

Acknowledging that there are likely to be significant political hurdles and perhaps even religious considerations to overcome, you can’t help but ponder the prospective added-value from the establishment of horse racing-related betting – either through pools or bookmakers – within those UK pubs and clubs which are continuing to perform above expectations.

For example, the J.D. Wetherspoon chain has over 800 locations across the UK, in addition to having over fifty hotels. Their founder Tim Martin is so often an outspoken Government critic, and unafraid to challenge/question the status quo. There are other similar pub groups – i.e. Greene King – who could also feasibly be willing to enter negotiations.

Such expansion, or even a simple modernisation exercise, could represent a win, win scenario for major bookmakers, or indeed for Britbet, the UK pool host and operator for 19 British racecourses.

Rob Waterhouse, a bookmaker, and the husband of legendary Australian trainer Gai Waterhouse also speaks with conviction about the issues facing the horse racing industry worldwide, condemning the constant barrage of negativity towards gambling,

“It’s a constant problem in this woke world, isn’t it? I suppose what I would say is that I think that it is a marvelous thing that the working man can have a bet and do the form, putting some intellectual exercise into finding a winner, which is perhaps his only opportunity in life to do so. It is very much part of the sport.”

“The problem is that in this world we live in, more and more money is being spent on social welfare and, as such, that money must come from somewhere, so gambling, of all sins, is an easy target. It’s a great shame.”

Although undeniable that strict regulations and major tax hikes – those taxes as high as 36.15% of Gross Gaming Revenue (GGR) in the Netherlands – are serving to punish the bookmaking industry, Waterhouse recognises that the ‘cost of living crisis’ has also had a direct impact on the habits of punters.

“In addition to betting on-course at Royal Ascot, I also bet in Sydney, in Melbourne, and in other places around Australia, and there is no doubt that cash has disappeared from people’s pockets.”

In stark contrast to this overall gloomy economic outlook, racecourse attendances are holding up well across Australia, with similar trends developing in the UK.

Nevertheless, this doesn’t always correlate with increased turnover for the traditional on-course bookmakers, with the ‘type of customers’ attending, and the recent emergence of ‘in-house’ bookmakers’ directly impacting on the volume of business.

Waterhouse has witnessed this shift of clientele stating, “as a bookmaker, I’d rather have ‘racing people’ at a meeting rather than people who are going to party and drink champagne” but he goes way further in condemning the ‘lack of value’ offered by ‘in-house’ bookmakers.

“The UK isn’t my country, but I do think that it is wrong that racecourses are bringing in their own ‘in-house’ bookmakers, or Tote systems. These operators are charging huge overrounds, which is so mean on the punters. I think the punters get a bad deal from [some] racecourses. It is wrong that they should do it. To me, it is almost stealing from the punters, so it is very bad.”

Despite these challenges, the primary focus for Waterhouse remains his profitable betting shops and on-course business, the online market now seen as being of little added value.

“Our turnovers have dropped but thankfully, the taxes are quite low for on-course bookmakers in Australia, as is the case in the UK. I have been involved with three online businesses, and I’ve sold all three. They [the Government] just keep on increasing the taxes on online businesses to the point where it’s just not profitable, so that brings great sadness.”

On-course bookmakers have next to nothing to fear from either black-market operators, or the ever more stringent affordability checks placed on customers by licensed and regulated online operators. Waterhouse is eager to promote the benefits of betting on track.

“In Australia there has been a rise [in black-market operators], with several people advertising themselves as bookmakers but they don’t have a license and have invariably taken the lot and not paid winning punters. I don’t speak with authority, but I suspect there will be a lot of people ringing their on-course bookmakers to bet because their taxes are lower.”

“As I understand it, in England, if you go into a betting shop there and want £100 on a horse, they’ll ask you to prove that you can afford it, requesting your bank records and proof of income and whatever else. It all seems very strange.”

So, with every single dimension of the bookmaking industry across Europe, Australia, and beyond, under threat, and the average yearling price in Australia for 2025 around A$149,000, ownership viewed by Rob Waterhouse as being “too expensive for the average person”, where do we go for a solution?

As Waterhouse correctly identifies, “Horse Racing is one of those great things where everyone can start a conversation about horses, or what have you backed here, or are you winning? It’s easy to start a conversation in relation to horse racing.”

For me, as the author of this report and as an enthusiastic devotee to horse racing, it is these channels of dialogue that remain key. It is essential that those who elect to devote their working lives to bookmaking, or the wider horse racing industry, remain united to the cause for the sport to thrive. It is simple; now isn’t the time for division, or worse, for self-preservation.

The key decision makers require foresight and a brave, bold new vision. There are a multitude of opportunities for horse racing and bookmaking to flourish as a collective force. Industry leaders in Britain, Ireland, France, Germany, Spain, Sweden, Australia, and wherever else, need to brace for a fierce political battle and, like their counterparts in Hong Kong, shift the narrative from a ‘risk of harm and addiction’ to focus on showcasing opportunities for growth and investment. With risk comes opportunity, and so often fortune favours the brave.

Racing and breeding in Turkey

Article by Paull Khan

The true scale of the thoroughbred industry in Turkey is surely widely underestimated. Turkey is indeed a big hitter in the racing and breeding world, but much of its activity flies under the international radar. This is perhaps not unsurprising, as Turkish racing is almost completely closed. Of the 3,159 thoroughbred races run in the country annually, all but six are closed to foreign-trained runners. All its races may be broadcast across two television channels, but pictures of Turkish racing are rarely seen abroad; and unless one has a Turkish identity number, one cannot place a bet on those races on the Turkish Jockey Club’s platforms. There are only 10 foreign-based owners in the country, and hardly any of its racehorses were bred anywhere other than in Turkey.

But shine a light on this sunniest and most welcoming of countries, and the vibrancy of the industry is remarkable.

Let’s take breeding first. The latest figures available to the International Stud Book Committee (the 2020 foal crop) show that Turkey is one of the few major thoroughbred breeding nations whose foal numbers have actually grown over the past decade. In 2010, Turkey ranked 15th in the world, in terms of number of foals bred, with 1,500. She now ranks as high as 9th in the world, with 2,103 foals – a 40% increase, no less, at a time when global production is in marked decline. Turkey is, in fact, the fastest-growing major breeding nation in the world. Amongst the top ten, only Ireland’s and Japan’s foal crops have increased over this decade, and both have seen much more modest growth than Turkey’s (15% and 11% respectively). And this Turkish expansion continues: some 2,280 foals were registered in 2022 – a further 8% rise.

Look down a racecard in Turkey, and you would be lucky to see a foreign-bred suffix beside any of the runners’ names. With only 24 out of 3,500+ horses having been foaled outside the country, such a racecard would be something of a collector’s piece. The explanation can be found in a regulation that only allows Thoroughbreds to be imported in the year of their birth. A striking example of the closed nature of Turkish racing, this rule is in place to support local breeders. Another disincentive to buying foreign-breds is that imported horses only receive 75% of the normal prize money.

So, it is domestic production that, almost exclusively, fuels Turkey’s racing product. But that does not mean Turkey is closed to the purchase of foreign bloodstock. Far from it. It has embraced a long-term policy of importing stallions and broodmares strategically to build up the quality of its herd over time. Ten of these stallions are currently owned by the Turkish Jockey Club (TJC) and stand at one or another of their various Stud Farms, which also hosts 47 privately owned stallions. In this way, they are able to offer world-class stallions to their mare owners at knock-down prices.

The most expensive stallion, at least of those whose fees are in the public domain, Luxor, stands at under €8,000.

Current Champion Sire, 1998 Belmont Stakes winner Victory Gallop (CAN), heads the roster of TJC-owned stallions. By the time TJC bought him from America in 2008, he was the sire of multiple-stakes winners. His nomination fee: around €3,000.

2007 Derby hero Authorized (IRE) now stands in Turkey.

A more familiar name to many European Trainer readers among the TJC’s team is 2007 Derby hero Authorized (IRE). Having stood at Dalham Hall, Newmarket and Haras de Logis in France, this sire of six individual Gp1 winners, as well as of Grand National winner Tiger Roll, was acquired by the TJC in 2019, where he stands at some €2,500.

Daredevil (USA), dual Gr1 winner for Todd Pletcher, was purchased by the TJC in 2019.

Daredevil (USA), dual Gr1 winner for Todd Pletcher, was purchased by the TJC in 2019 and stood the 2020 season in Turkey, before returning to his native USA to stand at Lane’s End Farm. However, the TJC have retained ownership of the horse.

Ahmet Ozbelge, General Secretary of TJC, explains the rationale behind this arrangement and the Turkish philosophy on stallion purchases. “After we bought Daredevil, his offspring Shedaresthedevil and Swiss Skydiver performed incredibly well; and we subsequently received many offers from various US stud farms to buy or to stand him. We evaluated all offers and decided not to sell him because of his young age but to stand him at Lane’s End. This is a first for the Turkish breeding sector, and we are glad to be in such a collaboration, to the benefit of the global breeding industry.

“In Turkey, we have very strict criteria for breeding stock purchases from abroad, based on performances of the stallion or the mare in question but also of his/her progeny’s performances. On top of that, we work hard to select the best-suited ones for our country’s specific conditions, including racetrack types, race dıstances, conformation and bloodlines. We also try to build up a good variety in our stallion pool in order to meet the various expectations of our breeders.”

Rising foal numbers are but one example of how Turkey is, in many ways, swimming against the tide. While many countries are seeing a slow decline in their racecourse numbers, Turkey is adding to its roll. Antalya is the latest addition, and it would take a brave punter to bet against further tracks opening their doors in the coming years.

Some €70M will be distributed across Turkey’s national race programme, creating a more than respectable average prize money of €8,200 per race, with owner’s and breeder’s Premiums boosting this to €11,300 per race.

The TJC has no fewer than 2,300 people on its payroll and an outlook that places social engagement higher up the list of priorities than do many racing authorities – perhaps in part to win over the hearts and minds of a populace which tends to be disapproving and to conflate racing and betting. For example, the racecourses offer not only pony and horse rides for the general public but also free equine assisted therapy for the handicapped.

Pony Rides for children and the disabled are routinely offered at Turkish racecourses.

How is an industry of this size sustained? In a word – and unsurprisingly – through betting. Horserace betting has long provided a rich seam of income for the TJC via a formula of which most racing governing bodies can only dream and which is likely to have yielded some €190M in 2022.

By international standards, the Turkish punter gets a raw deal, indeed, with only a 50% return on his stakes. The TJC retains an eye-watering 22% of monies staked, with the remaining 28% slice going to the government. Other income streams for the TJC pale into insignificance: any money from sponsorship, for example, is heavily taxed at a rate of 74%.

Enviable though the TJC’s position may be to many Racing Authorities, it rues the fact that sports betting enjoys yet more favourable treatment. “This is a key point, actually,” explains Ozbelge. “There is a seven-point tax gap between the two sectors in favour of sports betting, which allows them to offer higher payouts. As football is so popular and the most beloved sport in Turkey, we have so many common punters to both racing and football. As a result, they can easily be driven away from the lower payout environment to high payouts.” The paucity of the horseracing return is most evident in single bets, and least apparent in exotics such as the Pick 6 - the Turks’ favourite bet.

To support Ozbelge’s point, sports betting dwarfs horserace betting, accounting for no less than 90% – to racing’s 10% – of legal betting activity. To what extent this is due to the payout differential is difficult to tell. There is also the underlying relative popularity of football which he alludes to; and a further factor may be that, while racing offers pool betting, sports betting is fixed odds. (Exchange betting is outlawed in the country due to integrity concerns).

What is clear is that, with payouts so low, the temptation to bet via the illegal websites is high. “We import race meetings from different countries to prevent Turkish citizens from betting on illegal sites on these races,” continues Ahmet Ozbelge. Even so, it is estimated that the scale of illegal betting at least matches that of legitimate betting.

If European punters and bloodstock agents are likely to find the Turkish landscape somewhat alien, so too might trainers and owners, as the structure is, again, very different.

General Secretary Mr. Ahmet Ozbelge .

There are 795 trainers in the country whose licences allow them to train thoroughbreds or purebred Arabians. There are almost as many Arab races as thoroughbred races, and the prize money is similar. Between the codes, there are over 8,000 horses in training.There is no jump racing nor trotting. A quarter of the race programme is on turf: the majority of races are run on sand with around 10% on a synthetic surface.

To retain their licences, trainers must attend compulsory training sessions, which have heretofore been annual, but are about to be moved onto an ‘as required’ basis. The great majority of trainers train US-style on the racetracks, and each track has plentiful boxes for the local horses-in-training.

But here’s the thing: for the most part, trainers do not charge a fee to their owners, in the manner of those in Western Europe. Their sole remuneration is, rather, a percentage of their horses’ earnings – 5% or 10%. (Some do strike separate agreements with their owners for a fixed salary, but this is not the norm).

The owner, for his or her part, is then responsible for all their horses’ expenses. However, what one might imagine would be a hefty part of those costs – that of the horse’s stable at the racetrack – is again heavily subsidised by the TJC, who charge just €15 to €20 (depending on the racecourse) per annum per box. The owner’s total expenses – including the salary and insurance of the stable staff, feed, bedding, veterinary expenses, etc. – are not far in excess of €1,000 per month. But, lest this information should start a goldrush amongst European owners, salivating at the potential returns on investment, it should be explained that not everyone can become an owner in Turkey. One must have a Turkish residence permit and be able to demonstrate financial sufficiency. This explains why there are only 10 foreign-national owners on the TJC’s books.

Turkey is one of a select few European countries with internationally recognised Group races (the others being France, Germany, Great Britain, Ireland, the three Scandinavian countries and Italy). The Gp2 Bosphorus Cup (3yo+, 2,400m/12f) and Gp3 Topkapi Trophy (3yo+, 1,600m/8f) are the richest, worth north of €150,000. The Istanbul Trophy (Gr3), for fillies and mares, makes up its Group-race trio. All are run over the turf course at Istanbul’s impressive Veliefendi racetrack – the main centre and flagship of Turkish racing. They are joined by the International Thrace Trophy (turf) and International France Galop FRBC Anatolia Trophy (dirt), both of which are international Listed Races. The only other open race takes place at the nation’s capital, Ankara, being the Queen Elizabeth II Cup for two-year-old thoroughbreds; but this has never attracted any European runners.

The start of the Gazi Derby.

Richer than all of these is the Gazi Derby, a €330,000 race run over the classic mile and a half in late June.

Veliefendi is not, however, Turkey’s oldest racecourse. That honour goes to Izmir, at which members of the EMHF’s Executive Council spent a most enjoyable day’s racing in September, following this year’s annual meeting.

The window into Turkish racing has for some years been its International Festival, at which all Veliefendi’s international races are run. Its wide – up to 36 metres – turf track and attractive prize money once proved highly popular with foreign trainers, who frequently made the journey to Istanbul in September. The Topkapi Trophy , for example, saw a 10-year unbroken spell of foreign-trained winners, with Michael Jarvis, Mike De Kock, William Haggas, Richard Hannon Snr., Kevin Ryan, Andrew Balding and Sascha Smrczek all making the scoresheet. However, COVID has brought about a sea-change in behaviour, and there has not been a foreign-trained winner of any Turkish Group race for the past five years.

EMHF ExCo members at Izmir Racecourse.

Inevitably, the quality of the race fields has suffered. In 2022, the Topkapi Trophy had to be downgraded from Gp2 as a result, and the pressure on all the Turkish Group races is unlikely to ease unless and until the raiders can be enticed back.

Turkey’s governance structure is also a little unusual. The Ministry of Agriculture and Forestry plays a very hands-on role when it comes to regulation – appointing the Stewards and taking responsibility for race day operations and doping control. The Jockey Club itself operates under the provisions of a triad agreement with the Ministry of Agriculture and the Turkish Wealth Fund, which is the holder of the licence for racing and betting in Turkey.

The TJC prides itself on its not-for-profit status and ethos. Ozbelge explains: “Having a centralised governing system of the racing, breeding and betting activities by a nonprofit organisation with a non commercial approach, but rather a ‘horsemen’ one, with a main goal being to develop [the] racing industry by improving the racehorse breed in the country, has many advantages. This system supports the horse owners and breeders by offering them world-class stallions for very reasonable covering fees, offering boarding and veterinary services of high quality for minimum possible costs to them. Also, supplying the industry with well-educated jockeys in its own Apprentice School and delivering live broadcasting of all races through two TV channels and so on.

“But when one thinks about the cost of all of these investments as well as all the facilities that the Club has to operate with its staff of 2,300 experienced people, with betting revenue being its sole income, it’s easy to see that this has many challenges that come with it. But the main challenge is the unfortunate general perception of ‘gambling’ of our beloved sport, which is considered the king of sports and the sport of kings throughout the world. With a little bit of support or at least a ‘fair approach’ in comparison to betting on other sporting activities, Turkey has great potential to be a major player in the world league of horse racing.”

So, what are the prospects of the veil over Turkish racing being lifted?

There is hope of a new media rights deal which promises to bring pictures of Turkish races to an international audience. But those hoping to see Turkey adopt the policy of most of its European neighbours – namely that of having open races – are likely to be disappointed. Ozbelge again: “As Turkey is not in close proximity to major racing countries in Europe, horses cannot travel frequently by road as between central European countries, but only by air in order to participate in international races. As one can imagine, this is quite costly, and in order to attract some horses from abroad, the prize money is the key factor here. So, it all comes down to the economics of the industry and of the country for sure. We do plan and hope to have more international races, but we can realise it only if and when we have the right infrastructure and dynamics for it.”

Game face – can betting pools find a new market for European racing?

By Lissa Oliver

Where there is competition, there is gambling. Punters naturally take an interest in a sporting outcome and enjoy “putting their money where their mouth is” when it comes to having an opinion on the winner, but never more so than in horseracing. Rightly or wrongly, our industry seems to be inextricably interlinked with gambling and increasingly dependent on betting options. Can betting pools be turned to our advantage and bring in new fans?

A totalisator, or pari-mutuel system, is similar to a lottery in that all the stakes on a race are pooled with a deduction to cover costs and a contribution, where obligated, to racing. The remainder of the pool is divided by the number of winning units to provide a dividend.

On-course bookmakers are struggling to compete with online betting opportunities, and on-course pari-mutuels are no exception. The Irish Tote returned a year-on-year 33% decrease in 2018 to under €70m, due to falling international turnover. Yet a sliver of silver shines in the gloom for 2019, with first-half figures showing a 5.4% increase on-course.

Speaking to a government committee in November, HRI CEO Brian Kavanagh announced a strategic review of the Tote in Ireland, saying, “There is talk of a new gambling regulator being appointed and the taxation status of the Tote has been raised as an issue. The Tote is facing the same struggle as on-course bookmakers. We are in discussions with a number of parties with regard to the future of the Tote, and we will be bringing some strategic options to the board.”

It's interesting to note that in countries such as Ireland and Britain, where horseracing is managing to retain its popularity with the general public, the simple win-only bet is by far the most popular bet, suggesting punters are following form and looking outside our sport for more adventurous fun bets.

The most popular bet in Britain, Ireland, France, Germany, Spain and Switzerland is the win-only, in Greece the trifecta, multiples in The Netherlands, and in Denmark, Norway, Sweden and Russia, it’s the Jackpot that most captures public interest and investment. Understanding the market and what attracts customers is half the battle, but attracting new customers is the greatest challenge.

Cyril Linette

Cyril Linette is the CEO of the French PMU, the biggest betting pool in Europe and the third-largest in the world. Having turned the ailing fortunes of L’Équipe newspaper successfully around, he is now turning his attention to revitalising the PMU. Earlier in 2019, he outlined a new “operating roadmap” designed for corporate recovery and transformation strategy, reviving French racing for all stakeholders.

At a conference in April, Linette expressed confidence in PMU’s long-term prospects, despite declines across its portfolio in 2018—notably sports and poker betting down 2.3% to €9.7bn and horseracing down 2.6% to €8.8bn. This comes on the back of a 20% decrease in betting since 2011, when betting on horseracing has almost halved during that period.

In response to these declines, Linette has launched a €30m cost savings plan, sanctioning “strong actions” across PMU’s retail network, which currently generates 75% of corporate wagers. “If we do not find a solution, in five or 10 years the company puts the key under the door,” Linette warned starkly. As a result, the operator will no longer service the Brazilian horseracing market, ending its partnership with Rio de Janeiro’s Hipódromo da Gávea.

A key proposal is the revamping of the Quinté, which celebrated its 30th anniversary in 2019, removing all bonus rounds to make it “less reliant on chance.” Linette states his aim to simplify the Quinté: “The Quinté is a rather complicated game, not in its formula, but finding five horses is complicated. There are very simple bets where you just have to find the horse that will win, to attract a younger clientele. That is the big challenge in the years to come—to try to rejuvenate our clientele.”

Among other measures introduced is a new loyalty programme, to engage and reward regular French racing patrons.

“The PMU will place horseracing bettors back at the centre of its business, take good care of today's customers; because our PMU clients are important, they contribute to the social link, they contribute to the financing of the sector,” Linette vows.

This goes hand-in-hand with a nationwide campaign to improve the general public’s awareness of the sport and hopefully bring in a wider audience. “I do not know if the PMU is corny, but it's a world a little closed,” Linette acknowledges. "The younger generation is not going to naturally play PMU and does not always go to racetracks. There is a real value to our public image. The PMU is known but not sufficiently considered.”

Linette explains, “One thing is certain: diversification towards gambling is over. The PMU has had years of decay; we are no longer in the 1950s, 1960s or 1970s, during the glorious Thirty Years when we used to play the trifecta to buy our new clothes, caravans or something else. There was competition, so at one time the PMU went into lottery games, games of chance, and I think we were losing our soul a little.

“Basically, it's a life-size board game—you have to find the right combination, and the one who finds the right combination deserves to be rewarded, whether in very expert games like the Quinté or in games a little simpler like finding the horse that wins.

“I think we have two ranges of customers: the turfistes (400,000 people), which represent 80% of our turnover, and those who we could call the gamers (2 to 3 million people), which are more volatile. For the first, we must go back to fundamentals by erasing the maximum references to games of chance. Return to the DNA of horse betting, sagacity and gains. For the latter, we must work on image and innovation, so new types of bets to keep them or conquer them.” The message here is clear: stop trying to diversify and instead specialise for each group of particular clients.

Harald Dorum

The issue of attracting a fresh, new and younger audience is not just a problem for France. Paull Khan spoke with former CEO of the Norwegian Betting Operator Rikstoto, Harald Dorum, who stepped down earlier in 2019 to “allow a ‘new broom’ to attract a younger audience, with whom racing is struggling to communicate.” He remains President of the European Pari-Mutuel Association, however.

Dorum places much emphasis on the benefits of the pool betting model. Primary among these is the greater susceptibility to race-fixing of fixed odds bets and, especially, exchange models.

“The pari-mutuel operator is completely independent of the result of the race. If a punter places a large stake on an unexpected result, his winnings will be correspondingly lower. Moreover, bets on losers are not allowed,” he says and even claims, “In countries with the Tote model, there has been no case of fixed races for years.”

Despite this, pool betting has not been immune to a general trend in public opinion, which is hardening against gambling and focuses not only on its links to race or match-fixing but also on its use for money laundering, the growth of illegal betting and, perhaps most notably, on the social cost of gambling addiction.

“We have to modernise. We have to find a way of bringing a new and modern product to the market, while still taking care of the integrity of the sport. And fixed odds may be a part of that mix,” Dorum concedes.

He believes that the likelihood of public support will be increased if Tote has a real and clearly explained public mission, whereby some of its profits are directed to other causes, such as financial support of broader equestrian interests.

It is an oft-observed fact that there is no universal rule book for horseracing and the discrepancies in the interference rules significantly deter many punters. Dorum agrees that the recent progress in harmonising these rules under the so-called ‘Category 1 approach’—now uniform pretty much the world over save for North America—has “absolutely been good news.” Medication rules would be top of his list of the remaining rules to harmonise. Aside from harmonisation, Dorum believes that the sport’s rules must chime with the sensibilities of today’s population, in particular the need to limit the use of the whip to a broadly acceptable level.

Dorum concedes that progress towards a Global Bet, a single world-wide product available around the world and backed by strong marketing and branding has been very slow with neither the betting operators nor the racing authorities gripping the concept and taking ownership of it. But software developments promise an imminent technical solution, he believes. “Just like with a lottery, you have the chance for a life-changing win, but at the same time, you have a great experience.”

In his view, success in launching a Global Bet will require a joint effort between betting operators and Racing Authorities and this, in turn, will require a commitment in terms of time and policy prioritisation, from the global Racing Authorities, both for galloping and trotting races. And there is a general feeling that the key to this must be the support of the powerhouse that is the Hong Kong Jockey Club. For Dorum, it is political issues rather than technological or legal ones, that have hindered the Global Bet. For instance, he explains, a time of day must be agreed by all the parties, and a publicity programme then to surround it to give it the marketing reach.

Further, Dorum believes, “We need to increase our cooperation between Tote operators and find solutions and future products together.”

In this context, it has been reported that the PMU, Europe’s pre-eminent Tote operator, is considering its future within the EPMA. “I very much regret, if it will be the case, that the PMU will be leaving the EPMA in May and joining the World Lotteries Association. We and the WLA have a lot to learn from each other, and we have established a working group to determine how we might work and cooperate together.”

BUY THIS ISSUE IN PRINT OR DOWNLOAD

WHY NOT SUBSCRIBE?

DON'T MISS OUT AND SUBSCRIBE TO RECEIVE THE NEXT FOUR ISSUES!

EMHF - Positive EU decisions give cause for optimism

By Paull Khan

There have now been no fewer than five European Commission decisions, over the past five years, which have given the green light to member states wishing to introduce state aid in favour of their horseracing industries and which should be of great interest and encouragement to a number other European racing industries. If lessons can be learnt from these cases, this may help the racing industries in other European countries construct the arguments necessary to follow suit, thereby improving the financial health of our sport across the region.

Racing authorities the world over are engaged in conversations with their governments, seeking to establish, protect, or maximise statutory funding for horse racing as well as to safeguard the future health and stability of the industry and that of the breed. Normally, this funding takes the form of a statutory return to horseracing from betting.

So, typically, the racing authority must first provide good arguments to answer the question of why government should support such a guaranteed return to horseracing from betting (which would normally constitute special treatment for the sport). Then, in many cases, a further question has to be successfully answered: “Why should Government feel confident that objections on the grounds of state aid will be overcome?”

These five decisions – relating to France and Germany (in 2013) and to the UK, Finland, and Denmark (last year), are examples of racing authorities not only having convinced their governments to provide such assistance, but also of their governments having successfully argued before the European Commission that the measures introduced constituted ‘compatible’ (ie admissible) forms of state aid. These decisions should be of interest to those racing industries that either:

have no current statutory support, but where their government either allows, or is contemplating allowing, betting operators independent of the sport to take bets on their racing, or

have statutory support, but where the level of that support can be demonstrated to be insufficient to sustain the country’s racing industry, and/or the terms of that support can be shown to be in some way unfair.

TO READ MORE --

BUY THIS ISSUE IN PRINT OR DOWNLOAD -

Why not subscribe?

Don't miss out and subscribe to receive the next four issues!

Are racecourses selling their customers?

The world has gone gambling mad, and perhaps it will hit us harder than most people anticipate in coming years. There is fierce competition out there, for the betting pound, the gambling euro and the wagering dollar. Therefore, this is not a good time for horseracing to lose its share of the gambling pot.

Geir Stabell (European Trainer - issue 22 - Summer 2008)

The world has gone gambling mad, and perhaps it will hit us harder than most people anticipate in coming years. Quite how it hits us, will be crucial to the future of horseracing. Or, perhaps one should say, quite how it does not hit us will be of great importance.

There is fierce competition out there, for the betting pound, the gambling euro and the wagering dollar. Therefore, this is not a good time for horseracing to lose its share of the gambling pot. This is not the time to "sell our customers". This is the time make some shrewd business decisions and draw up some productive long term strategies. These are also days when we are heading into a global recession. Believe it or not, that will not necessarily slow down the betting market. Studies have shown that people are quite likely to bet more when times are hard. Gambling becomes the only way to put a little bit extra in the pocket. So, this is the time for racecourses, racing publications and racing communities to be competitive to promote racing as a betting product. To promote the sport as the best betting product.

Are they taking this opportunity? To a certain extent yes', but unfortunately in many cases no', and seemingly never very well. Many courses are today promoting sports betting, online poker betting and online games. Yes, sponsors and advertisers from these sectors of the betting market plough money into racing, in the short term, but it is my guess that long term, racecourse managements and racing editors will be regretting taking that carrot in the first place. Why are companies taking bets on sports, such as football, golf and tennis, eager to advertise at our racecourses, in racing publications and in our racecards in the first place?

The answer is very simple, they are trying to move gambling money across from horseracing to their own betting products. That is the only reason they promote their products at the racecourses. And, to our astonishment, the racecourses allow it. What is happening is as absurd as it would be if all McDonald's restaurants in this world had huge posters promoting Kentucky Fried Chicken. "No, hang on a bit" you might think. But that is actually quite a good comparison to what is going on in horseracing these days. Let's take a premier European racecourse as an example. Why not look at Newmarket, and their Guineas weekend last year. Stan James Bookmakers sponsored the Guineas meeting, and over the two days this company had 14 full pages of advertisements in the racecards (plus the four cover pages on both days). This is how they decided to make use of the 14 pages: 8 pages promoted online poker and online games. 4 pages promoted Stan James Bookmakers only. 2 pages promoted betting on horseracing (although as free bet competitions). To put this another way, 57% of the sponsor's advertising space was used to promote forms of betting which is in direct competition with horseracing. Only 14% of the space was devoted to horseracing alone. The two most strategically placed advertising pages, immediately preceding the 2,000 Guineas pages and immediately before the 1,000 Guineas pages, were both used to promote online poker. This is a typical example of how bookmakers use a sponsorship deal with a racecourse these days. They are clearly not going into such an agreement solely to get people to bet more on racing. They are not even primarily trying to get people to bet more on racing.

Quite the opposite. The Stan James Guineas meeting is not the only example. On Saturday August 11, the opening day of the Football Premiership season in England, Newmarket's card was sponsored by the bookmaking firm Skybet.com, and their four sponsored races on the day had the following titles: The Skybet.com for all you football betting handicap The Premiership kick off with Skybet.com handicap The Skybet.com Sweet Solera Stakes (g3) The interactive football betting with Skybet live stakes Only the feature event, the Sweet Solera Stakes, was not used to promote betting on football. Again, the bulk of the sponsor's advertising went towards attracting punters to bet on others sports not on horseracing.

There can be no doubt that racecourses need their sponsorship revenue quite badly but this is probably not an ideal way to earn it. When a racecourse with a high profile like Newmarket can be dictated to in such a way by sponsors, what about the smaller tracks? Don't forget that sponsorship deals like those described above are, in effect, a case of horseracing "selling their customers". For every pound or euro bet on other sports, casinos, or poker, there will be one pound or euro less bet on horseracing.

Why does a company sponsoring a classic horserace choose to devote nearly 60% of the advertising space included in the package to promoting non-racing betting products? It is hardly because the company sees a great future in horseracing, is it? Nor is it as a result of their care for the future of horseracing. It is simply a business decision - and it is part of a long term plan. When you go to a big football match, or watch a match on TV, do you see many adverts, banners or boards promoting horseracing and betting on horseracing? If you do, please let me know, as I believe it would be a rare sight indeed. If you decide to try your luck in online games or online poker, you enter a web site offering such products. How many ads or banners promoting horseracing will you see on these sites? Having done a quick test, looking at ten poker sites, my discovery was, to no little surprise, "0-from-10". As touched on in my piece on the Global Superbet in Trainer Issue 20 (Winter 2007), one big danger for horseracing is that these competing products are so, so much cheaper to operate, which puts horseracing at a great disadvantage. Should horseracing break loose altogether from these other forms of gambling, or should racing people work towards making these relationships closer, and hopefully healthier for racing?

The current state of affairs is not a case of horseracing in a mutually beneficial co-operation with other betting markets. It smacks more of a case of other betting markets exploiting horseracing. And the powers to be in horseracing seem to be happy to let this to continue. The installation of slot machines has generated revenue for racecourses in North America; that is a fact. It is also a fact, however, that at many of these courses, the betting turnover on the races has gone down since the slots arrived. The horse is becoming less and less important.

Take a look at this cutting, from an article published on the web site videopokerslots.co.uk last year: "Maryland racing industrialists were curious and apprehensive about the potential impact of their new nemesis: Delaware Park's slot machines. But after several weeks of operation, the apprehension between Marylanders has disappeared - now it has become an all out hysteria. The reason: slots have overtaken horse racing. Delaware's slot machines have become a hit that any business would consider phenomenal. Imagine, they're making $300 per machine, and they have a total of 715 slot machines - that's more than $200,000 a day. As stipulated, slot machines should earn $10 million as additional revenues for the Delaware's racing season, consequently grabbing the thoroughbreds from Maryland. Delaware's minor league harness track has quintupled since the installment of slots in the area and is now a major competitor with other race tracks. If this were any other industry, Maryland's tracks would also install slot machines. But slot machines are a hot political debate, while the racing tracks are so strictly regulated that minor changes needs a state-wide approval. These are troubled times for the thoroughbred industry. If racing tracks continue to lose revenue, they would have to ask for slot machines. If legislators won't approve, they'd ask to at least give them economic relief to help them commercially survive." Betting on slot machines has overtaken' betting on horseracing, but at least this North American course operates their own casino-like betting products.

Many racecourses in the USA do have the opportunity to take a "if we can't beat them, let's join them" stand. Still, while the gamblers are taking an increasing interest in betting on slots and other games, they seem to be losing interest in horseracing. US racecourses do not, unlike courses in England, allow extensive advertising from companies in direct competition with their own betting products.

In England the financial muscle of non-racing betting operators is making an all-round mark on racing, not just by ambushing the racecourses with seemingly lucrative sponsorship deals. The media is another side to this, with TV channels and publications offering advertising opportunities. This is all black and white The Racing Post, Europe's principle horseracing daily, and one of the biggest in the world, has developed in a similar way to the racecourses over the past ten years. This paper has a daily "sports betting section" at the back, typically taking up 20 to 24 pages, including the greyhound racing coverage. On Saturdays, the sports section is a separate paper in the middle, often up to 40 pages thick. Now, that may not seem too bad, as the main paper will have 100 pages. What is interesting though is to take a look at the proportion of editorial pages and advertisements. Taking a randomly chosen Saturday, I discovered that the paper had 11 editorial pages on horseracing (excluding the racecards) yet as many as 10 editorial pages on football and other sports. This balance, or imbalance if you will, is simply driven by market forces. Of course the paper needs advertising revenue, and they therefore need to cover the areas their advertisers are interested in.

This is all so easy to understand, it is all "black and white". To the accountants, that is. Examining the same Saturday issue of The Racing Post reveals the facts about how the advertising space for betting was sold. The chosen day was January 26, with the Festival Preview day at Cheltenham, and racing at six courses in all in England and Ireland: Approximately 10 advertising pages exclusively devoted to betting on horseracing Approximately 11 advertising pages exclusively devoted to betting on other sports When looking at the full-page advertisements on the same day, it is interesting to note that the paper carried four full-page ads promoting betting on racing (including one for a betting system), compared to six full-page ads promoting betting on other sports. When watching horseracing on TV, the situation is very similar. On big days, a large proportion of the commercial breaks are promoting non-racing betting products. We have all seen them, the online games commercials, the commercials promoting betting on football, or playing poker online, nicely positioned before a Group One race is due to go off. This happens also on the TV channels originally devoted to and backed by horseracing. In England, the channel At The Races last year decided for a trial period to end its North American program at 11pm GMT (when the pubs are closing), in order to make room for a poker program lasting three hours. What did this mean? It meant that the racing went off air before many of the big stakes events are run in the USA. So, lower grade racing was being shown, and competing with high profile football matches and other TV programs, before eventually making way for poker. What this also means, and this is the most interesting side effect: that horseracing has lost control over its own product.

It seems bizarre that while horseracing authorities and racecourse managements have been fighting long and hard for their control over the rights of live pictures from the racecourses, they have accepted broadcasting schedules that include loads of commercials promoting betting products that are in direct competition with horseracing. They may believe that they have indeed protected the rights to live pictures, and technically they have, but they have absolutely no control over the end product being offered to the viewer. In the TV world, it is sometimes a bit difficult to say who makes the crucial decisions, but it is fair to say that in many cases it is the sponsors. Perhaps you will now be saying, yes, this article is interesting but there is precious little here that we did not already know'. Well, that may be. But don't forget, sometimes stating the obvious is the best way of saying why is nobody doing something about this?'

The further you drive down a narrow dead end street before realising your mistake, the more troublesome it will be to reverse all the way back out again and the longer it will take. And, in the fierce competition for the betting pound, euro and dollar, time is of the essence. Do not let it run out. If someone is going to instigate serious changes in this muddle, that someone will certainly have to come from within the horseracing industry. It is all in our own hands. For the time being.

Global Superbet -can it take horseracing to a bigger stage?

Twenty-five years ago John R. Gaines in Kentucky came up with an idea: the Breeders' Cup series. Gaines felt that Thoroughbred racing needed a high profile day, which would make it possible for the sport to compete with NFL, NHL and NBA in the media picture. Everyone involved in racing agreed, just as much as they agreed that Thoroughbred breeding and racing needed new innovations, offering opportunities for more international competition with chances of winning bigger purses. Has it worked? Partly, and the Breeders' Cup has most certainly been more a star actor than just another face to the stage.

Geir Stabell (14 February 2008 - Issue Number: 7)

By Geir Stabell